1031 Exchange Overview for Student Housing

1031 Exchange for Student Housing

A Student Housing 1031 exchange allows you to defer paying taxes when you sell an investment property, by reinvesting the proceeds in a qualifying replacement student housing investment property under the Internal Revenue Code Section 1031.

Learn Eight Great Reasons to Add Student Housing to Your Portfolio.

Eight Great Benefits of a 1031 Property Exchange!

Learn how investing in a 1031 property exchange can benefit you!

1. DEFER YOUR CAPITAL GAINS TAX

Allows investors to defer capital gains on the sale of their real estate.

2. MONTHLY CASH FLOW

Investors can sell a little/no income producing property (e.g. land) and purchase property(s) with greater cash flow performance (e.g. student housing).

3. LEVERAGE

Funds saved by deferring capital gains and other taxes, investors have increased funds to purchase a larger property.

4. CONSOLIDATION

Investors can sell smaller properties and purchase one larger property to maximize ownership benefits and reduce management responsibilities.

5. INCREASE DEPRECIATION

Investors can exchange from a non- depreciable property (e.g. land) to a property that can be depreciated (e.g. student housing).

6. PROPERTY MANAGEMENT RELIEF

Investors who no longer want to manage high-maintenance properties can reinvest in properties requiring little or no management.

7. PORTFOLIO DIVERSIFICATION

Investors can expand the number or types of property in their portfolio in addition to investing in various markets and/or states.

8. ESTATE PLANNING

Investors may continue to replace properties through consecutive 1031 exchanges, preserving profits until and estate can be passed down tax free (if under the tax cap).

4,600 College Institutions Service 20 Million Students.*

*National Center Of Educational Statistics 2016

Top Reasons to Add Student Housing to Your Portfolio

Here are some of the top reasons why adding student housing asset class to your portfolio is a good idea.

1. Recession-Resistant Characteristics

Student housing occupancy rates remain stable during economic booms and may actually rise during downturns because of increased college attendance.

2. Students Are Staying in School Longer

Four years is no longer the standard for degree completion. According to the U.S. Bureau of Labor Statistics, exactly two-thirds of high school grads are taking significantly longer to complete their degrees. Where are they going to live while in school?

3. Increase of Rental Rates

Overall the rental revenue, rental rates, and net operating income in student housing properties across the country have continued to rise year over year due to student demand and limited space.

4. Value-Creation Potential

Increased student housing demand by renovating and creating value-add improvements to the properties, may help realize higher returns at a faster rate as compared to the acquisition of stabilized assets.

5. Optimal Investment Strategy

Student housing provides appreciation potential, an inflation hedge, portfolio diversification, and monthly income with tax efficiency through depreciation anchored by student housing assets.

Our Student Housing Strategy

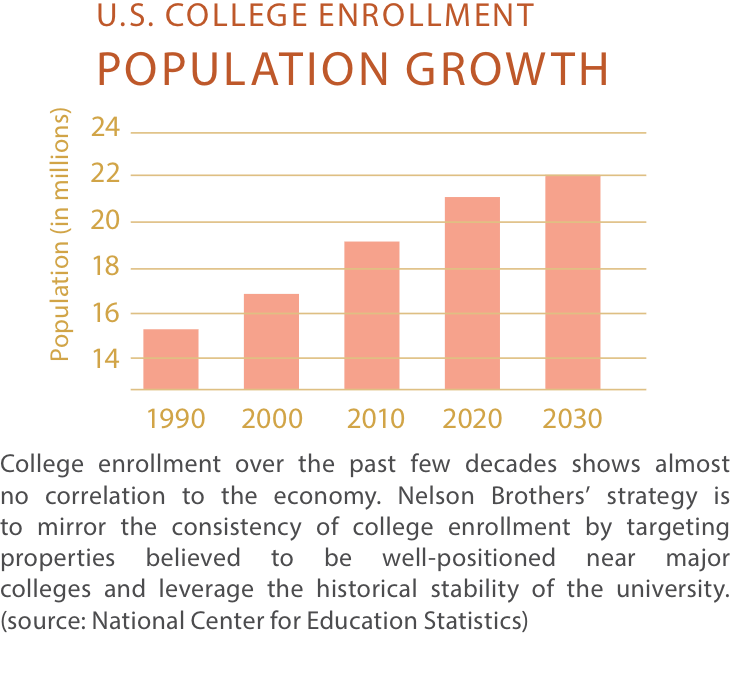

Nelson Partners believes that well-positioned housing for students near campus can leverage the economic stability of a major university and cater to a demand with less volatility than the macro-economy. Our strategy is to target the well-located properties within walking distance to growing universities that fit within the company’s proprietary buying model. In particular, the company will emphasize value-added opportunities, targeting well-located properties that can be upgraded from extensive renovations with a more contemporary look and feel. The key will be to make cost-effective improvements that students could potentially be willing to pay a higher premium for; helping to raise rents, grow income and appreciate property value.

College Enrollment Growth in the United States is projected to go to 24 million by 2022**

https://nces.ed.gov/pubs2014/2014051.pdf

We believe well-positioned student housing has the potential to offer a variety of benefits that matter to investors: monthly cash flow, stable performance, inflation-friendly, appreciation, and tax efficiency through depreciation, all from a brick-and-mortar asset anchored by the historical stability of a university.

Student Housing Investment Strategic Categories

Our Student Housing Criteria Selection

1031 Property Exchange FAQ's

Learn some of the common questions about a student housing 1031 property exchange.

What is a 1031 Exchange

A 1031 Exchange (a Section 1031 of the IRS Code) allows investment property owners to sell their property through an “exchange” by purchasing a “like- kind” property and defer up to 100% of the capital gains taxes which would otherwise be due upon the sale of their property.

3 Steps to Completing a 1031 Exchange

1. Retain a Qualified Intermediary

to sell your existing property and hold the sale proceeds in escrow.

2. Identify a Replacement Property

from Nelson Partners within 45 days after the sale of your property.

3. Purchase Your Replacement Property

to complete your exchange within 180 days after the sale of your property.

80% of College Students Live Off-Campus

J Turner Research On Student Housing

1031 Exchange Ownership Options

You can own a 1031 property one of two ways:

Full Ownership

• Sole Owner

Buy the entire invest property and be the sole owner.

-OR-

Fractional Ownership

• TIC: Tenant-in-Common

Investors are considered co-owners and hold a direct ownership position in the property.

• DST: Delaware Statutory Trust

Investors buy an ownership interest in a trust that holds title to the property.

1031 “Like-Kind Property Types

The term “like-kind” refers to the nature or character of the property, rather than its grade or quality. The relinquished or replacement property cannot be the investors primary residence.

- Apartment Buildings

- Condominiums

- Duplexes & Triplexes

- Hotels & Motels

- Industrial Properties

- Office Buildings

- Rental Resort

- Retail Centers

- Senior Housing

- Single-Family Rentals

- Student Housing

- Vacant Land

- Warehouses

1031 Exchange Guidelines

The term “like-kind” refers to the nature or character of the property, rather than its grade or quality. The relinquished or replacement property cannot be the investors primary residence.

- Sales proceeds must go directly to accommodator

- 45 days from close to identify replacements

- 3 rules for Identification: 3-property, 95%, 200%

- 180 days from sale to close on replacement(s)

- Must maintain the same ownership entity

- “Upleg” must have same sales price or higher

1031 Exchange Property Identification Rules

When you identify potential replacement properties for your 1031 exchange, you must comply with one of the following three rules or your identification will fail.

3-Property Rule

Most investors use this option. This rule allows you to identify up to three potential replacement properties regardless to their fair market value and acquire any or all of them.

200% Fair Market Value Identification Rule

An investor may identify any number of potential replacement properties as long as their combined value (purchase price) is less than 200% of the sale price of the relinquished property by the end of the identification period.

95% Rule Identification Exception

Similar to the 200% rule, the 95% rule allows your to identify any number of replacement properties without regard to price as long as you actually purchase 95% of the value you identify.

1031 Exchange Terminology

Learn the most utilized 1031 Exchange terms that are used today.

1031 Exchange Potential Risks

All real estate involves risk. Properties can be subject to market fluctuations, seasonal fluctuations, vacancy, higher-than-expected expenses, and other risks. In some cases this may lead to a reduction in distribution levels or even foreclosure in extreme cases. Please consult the Private Placement Memorandum (PPM) of any 1031 Exchange offering for a more complete list of potential risk factors.

Nelson Partners 1031 Exchange Solutions for Student Housing

NP puts together 1031-eligible investments in real estate.

Enable smaller investors to own institutional-grade properties.

Properties can be turnkey, with loan, price and strategy in place for potentially simpler 1031.

Eliminates the hassles of tenants for landlords.

Over the next 15 years 68% of High School Graduates will attend colleges or universities.*

*Bureau Of Labor Statistics 2016